Many business owners find themselves spending valuable time managing complex financial requirements instead of focusing on growth. This struggle often leads to compliance risks, missed opportunities, and unnecessary stress.

Financial accounting advisory services offer a solution that goes beyond basic bookkeeping. These specialized services provide expertise and guidance that can transform your financial processes, ensuring accuracy and compliance while unlocking strategic insights that fuel business success.

The Current Challenges

With tax codes, industry regulations, and accounting standards constantly changing, staying compliant requires dedicated attention and specialized knowledge.

Common challenges include:

- Keeping pace with regulatory changes: The IRS and other regulatory bodies frequently update requirements, making it difficult for business owners to stay current.

- Maintaining accurate financial records: Without proper systems, critical financial data may be recorded incorrectly or inconsistently.

- Finding time for strategic financial analysis: Many business owners are too busy with day-to-day operations to analyze financial data for growth opportunities.

- Preparing for audits and reviews: Without proper preparation, financial audits can be stressful and potentially reveal costly compliance issues.

What are Financial Accounting Advisory Services?

They offer a comprehensive suite of solutions to help businesses optimize their financial processes, improve decision-making, and ensure compliance with industry regulations. These services can include:

- Financial Reporting: Preparation of accurate and timely financial statements, including balance sheets, income statements, and cash flow statements. Think of it as telling the story of your business through numbers.

- Compliance: Ensuring adherence to accounting standards, tax laws, and other regulatory requirements.

- Internal Controls: Designing and implementing internal controls to safeguard assets and prevent fraud.

- Risk Management: Identifying and mitigating financial risks.

- Mergers and Acquisitions: Providing financial due diligence and advisory services for M&A transactions.

- Forensic Accounting: Investigating financial irregularities and fraud.

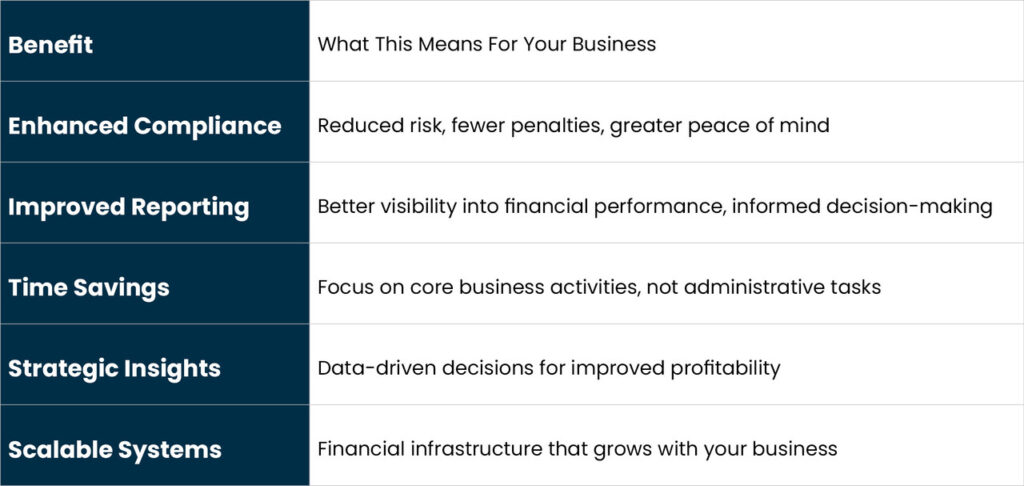

Benefits At A Glance

1. Enhanced Compliance Management

Financial accounting advisory services ensure you stay current with regulations, implement compliant processes, and prepare accurate tax filings. Start with our basic bookkeeping tips and build from there to a comprehensive compliance strategy.

2. Improved Financial Reporting Quality

Get clear visibility into your business’s financial health through standardized templates, consistent processes, and accurate data verification. Better reporting builds confidence in your financial data and enables more informed business decisions.

3. Time and Resource Optimization

Reclaim valuable time previously spent on financial management through streamlined processes, automation, and expert support. This time savings allows you to focus on strategic activities that drive growth.

4. Strategic Financial Insights

Transform raw financial data into actionable insights that inform your business strategy. Identify profitability trends, analyze cash flow patterns, and receive data-driven recommendations that support better decision-making across your operation.

5. Scalable Financial Infrastructure

As your business grows, your financial systems evolve with you. Advisory services implement appropriate technologies, create documented procedures, train team members, and develop controls that support your business at every stage of growth.

Why Accurate Financial Reporting and Compliance Matters

Accurate financial reporting and compliance are essential for the success of any business. Here’s why:

- Informed Decision-Making: Reliable financial information provides a clear picture of your business’s financial health, allowing you to make informed decisions about investments, expenses, and growth strategies.

- Compliance with Regulations: Staying compliant with accounting standards, tax laws, and other regulations is important to avoid penalties, legal issues, and damage to your business’s reputation.

- Attracting Investors: Accurate financial statements are essential for attracting investors and securing funding. Investors need to see a clear and transparent picture of your financial performance to assess the viability of your business.

- Building Trust with Stakeholders: Transparent financial reporting builds trust with stakeholders, including customers, suppliers, and employees. It demonstrates that you’re running your business with integrity and accountability.

- Measuring Profitability: Accurate financial reporting allows you to track your income and expenses, measure your profitability, and identify areas for improvement.

- Planning for the Future: Financial reports provide valuable insights into your business’s past performance, which can be used to forecast future trends and plan for long-term growth.

The Implementation Process

Transitioning to a financial accounting advisory relationship follows a structured process designed to minimize disruption while maximizing benefits:

Phase 1: Assessment and Discovery

- Review existing financial systems and reports

- Identify compliance requirements specific to your industry

- Evaluate current accounting resources and capabilities

- Document financial goals and challenges

- Assess technology needs and opportunities

Phase 2: Strategic Planning

- Create a customized service plan

- Develop implementation timelines

- Define roles and responsibilities

- Establish key performance indicators

- Set clear deliverables and expectations

Phase 3: Implementation

- Set up or optimize accounting systems

- Implement standardized processes

- Establish reporting frameworks

- Train team members on new procedures

- Create documentation for financial processes

Phase 4: Ongoing Advisory Support

- Regular financial reviews and updates

- Proactive compliance monitoring

- Performance analysis and recommendations

- Strategic financial guidance

- Process refinement and optimization

Industry-Specific Considerations

Effective financial accounting advisory services recognise these differences in industry, adapting approaches to specific sector needs.

Professional Services

Service-based businesses like consulting, legal, or marketing firms have unique financial considerations:

- Time tracking integration with financial systems

- Project profitability analysis

- Milestone billing and revenue recognition

- Capacity utilization metrics

- Labor cost management

Construction and Contracting

Contractors face complex financial reporting challenges:

- Project-based accounting

- Progress billing and revenue recognition

- Contract compliance documentation

- Equipment depreciation tracking

- Subcontractor management and retention accounting

Healthcare Practices

Medical and healthcare organizations balance clinical operations with strict financial regulations:

- Insurance billing reconciliation

- Procedure profitability analysis

- Healthcare compliance requirements

- Provider productivity reporting

- Patient financial management

Manufacturing

Manufacturing businesses manage intricate cost structures and inventory considerations:

- Materials and production costing

- Inventory valuation and management

- Equipment depreciation and maintenance tracking

- Production efficiency analysis

- Supply chain financial integration

Common Pain Points And Solutions

Measuring The ROI Of Financial Accounting Advisory Services

While some benefits are immediately quantifiable, others deliver long-term value through risk reduction and improved decision-making.

1. Time Savings

- Hours saved on financial tasks

- Faster month-end closing

- Reduced audit preparation time

- Quicker financial analysis and reporting

These time savings translate directly to reduced costs or increased focus on revenue-generating activities.

2. Error Reduction

- Fewer accounting corrections and adjustments

- Reduced tax filing amendments

- Decreased compliance penalties

- Lower audit findings

Reducing errors reduces both direct costs and operational disruptions.

3. Financial Performance Improvements

- Increased profit margins

- Improved cash flow management

- Better working capital utilization

- Reduced financing costs

- Enhanced budget accuracy

Strategic financial insights often lead directly to improved financial results.

4. Business Valuation Impact

- More accurate financial representations

- Stronger compliance history

- Documented financial procedures

- Cleaner financial records

- Improved financial predictability

These factors can increase business valuation for potential sale or investment.

The Finish Line

For MyOfficeOps clients, the “finish line” represents a state of financial clarity, control, and confidence. It means:

- Accurate and Timely Financial Reporting: Having access to reliable financial data that informs decision-making.

- Stress-Free Compliance: Knowing that your business is in compliance with all applicable regulations.

- Improved Profitability: Seeing tangible improvements in your bottom line as a result of data-driven insights and strategic guidance.

- Sustainable Growth: Having a solid financial foundation to support future growth and expansion.

- Peace of Mind: Being able to focus on your core business without worrying about the complexities of accounting and compliance through our virtual CFO services.

Contact us today to schedule a consultation and learn how we can help you achieve your financial goals. Visit our website to learn more and download our free financial growth guide.

FAQs

How is financial accounting advisory different from regular bookkeeping?

While bookkeeping focuses on recording transactions, financial accounting advisory provides strategic guidance, compliance oversight, and business insights from your financial data.

Do I need to switch accounting software to use your services?

Not necessarily. We work with various accounting platforms, though we are certified QBO ProAdvisors and can help you transition if that would benefit your business.

How quickly will I see results from financial accounting advisory services?

Most clients experience immediate time savings and see significant improvements in financial clarity within the first 30 days, with strategic benefits unfolding over 3-6 months.

Is financial accounting advisory only for large businesses?

No, it’s valuable for businesses of all sizes, especially growing businesses with 11-50 employees facing increasing financial complexity.

What if I already have a bookkeeper?

We can work alongside your existing bookkeeper, adding strategic oversight while they handle day-to-day transactions.

How much does financial accounting advisory typically cost?

We offer transparent monthly pricing based on your specific needs, typically ranging from $1,000-$5,000 per month depending on business complexity.

Can you help with industry-specific compliance requirements?

Yes, we tailor our approach to your industry’s specific financial reporting and compliance needs, whether construction, healthcare, professional services, or manufacturing.

What happens if we get audited?

We provide comprehensive audit support, ensuring your financial records are accurate, complete, and properly documented to simplify the audit process.